XMB

XMB

XMB

XMB

SAVE & MANAGE YOUR MONEY

Banking is the practice of accepting and safeguarding money owned and then lending out this money in order to earn a profit.

Partner with us

Cumulative trading volume

Successful Projects

World active user

Welcome to XMB Finance, where your financial aspirations find expert guidance and support. At XMB, we specialize in empowering individuals and businesses alike to navigate the complex world of finance with confidence.

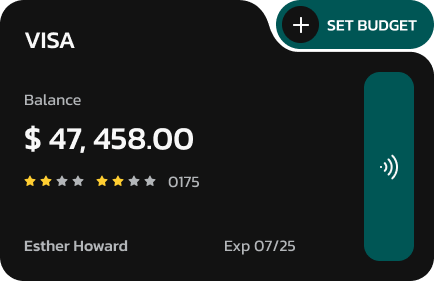

Experience the convenience and accessibility of Online and Mobile Banking with XMB Finance. Seamlessly manage your finances anytime, anywhere, with our secure and user-friendly platforms.

Integrate XMB Finance into your website to offer fast, secure, and seamless online bank transfer payment methods. With XMB Finance, you can receive payments directly into your company bank account or open a dedicated merchant account to streamline fund collection.

Empower your customers with a convenient payment solution that ensures their transactions are safe and efficient. Join forces with XMB Finance to revolutionize your online payment experience today.

Stay updated. check your bank account to manage funds and track transactions securely.

The rise of cryptocurrencies has opened up new trading In this beginner's guide to cryptocurrency trading we demystify the world of digital currencies

Charts trading

Supreme Authority

Worldly Power

Global Dominance

Use customer data to build great and solid product experiences that convert.

$10

/yr

Minimum Investment

$100

Investment Duration

30D

Daily Returns

2.0%

Total Return

160%

$30

/yr

Minimum Investment

$500

Investment Duration

60D

Daily Returns

2.5%

Total Return

230%

$75

/yr

Minimum Investment

$1000

Investment Duration

90D

Daily Returns

3.0%

Total Return

475%

Highlights the impact of technology on the banking industry, enabling convenient digital access to financial services.

Execute pay outs and refunds straight to your customer’s bank account via Xmb Finance.

Get in touch with us, and we will help you to create the right one for your business or personal needs.

Apply for a loan

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

If you notice any suspicious or unauthorized activity on your account, follow these steps: 1. Contact your bank or credit card issuer immediately. 2. Report the fraudulent transactions and provide details of the unauthorized activity. 3. Request to block or deactivate the affected card or account. 4. Follow any additional instructions provided by your bank to resolve the issue.

Read our blog and try to see passion liesin making everything accessible andaesthetic for everyone.

Latest News December 12, 2022

The future of fraud protection.The future of fraud protection is evolving rapidly, driven by advancements in technology and data analytics. With the rise of artificial intelligence and machine learning

Read More

Latest News December 12, 2022

The future of fraud protection.The future of fraud protection is evolving rapidly, driven by advancements in technology and data analytics. With the rise of artificial intelligence and machine learning

Read More